Solar market sees brighter future

Strong results from leading photovoltaic (PV) panel suppliers, combined with increased solar activity in leading markets such as Germany, indicate that the solar market is recovering from the huge slump that occurred earlier this year.

LDK Solar Company Limited and Trina Solar Limited have both posted strong third-quarter financial results. LDK Solar recorded operating profits of $56.8 million (37.7 million euros), compared to a massive $205.5 million (136.4 million euros) net loss in the second quarter.

LDK CEO Peng Xiaofeng said: "Global multi-crystalline wafer demand rose sharply in the third quarter. Our company's third quarter performance reflects a general improvement in the solar PV industry."

Trina Solar posted total revenues of $249.7 million (165.7 million euros) for the third quarter, up more than 66% from the second quarter. The company also shipped 123 megawatts (MW) of solar modules in the third quarter, up almost 92% on from the previous quarter.

Demand for panels has been on the increase in the third quarter, with analysts at New Energy Finance claiming that the cost of installing solar, based on the 'levelized cost,' or the unsubsidized cost per kilowatt-hour, will have fallen 50% by the end of the year. For other renewable power sectors, the drop will be about 10%.

"So far this year, the steady decline in the cost of equipment in sectors like solar and wind has been largely offset by the increasing costs of financing," said Michael Liebreich, chairman and CEO of New Energy Finance. "By the end of this year, however, as capital markets loosen up and equipment prices continue their decline, we will see the levelized costs decline, finishing the year 10% below the end of last year across the board, and far more than that in solar."

Photovoltaic (PV) module prices have fallen continuously in recent months with thin-film panels showing far greater price drops than the more expensive crystalline silicon systems used in less sunny locations.

In Europe, there has been a surge in demand for solar in Germany since the third quarter. Germany is now the biggest European solar market since Spain's government severely capped its very generous feed-in tariffs for 2009. Since then, Germany, which still has a feed-in tariff in place, has become the focus for many suppliers and investors.

"Solar-panel installations in Germany began surging to record levels in July as prices for PV systems plunged," said Dr. Henning Wicht, senior director of photovoltaics research for iSuppli. "This phenomenon has boosted the global solar panel business and mitigated the severe oversupply situation that has stung the industry throughout this year."

iSuppli predicts that Germany will install 2.5 gigawatts (GW) of solar panels in 2009, up from the previous forecast of 1.53 GW. The prediction is borne out from other sources, including the German Solar Industry Association (BSi), which said that Germany will install up to, but not more than, 3 GW of photovoltaic capacity this year.

Overall, largely because of Germany's surge in demand and more positive signs in the U.S. and Chinese markets, BSi expects global demand for 2009 to hit 5.2 GW, up from the previous, less optimistic prediction of 3.9 GW.

Related News

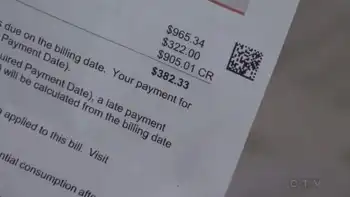

Christmas electricity spike equivalent to roasting 1.5 million turkeys: BC Hydro

VANCOUVER - BC Hydro is reminding British Columbians to conserve power over the holidays after a report commissioned by the utility found the arrival of guests for Christmas dinner results in a 15% increase in electricity usage.

Cooking appears to be the number one culprit for the uptick in peoples’ hydro bills. According to BC Hydro press release, British Columbians use about 8,000 megawatt hours more of electricity by mid-day Christmas — that's about 1.5 million turkeys roasted in electric ovens.

article continues below

About 95% of British Columbians said they would make meals at home from scratch over the holiday season.…