PG&E Bankruptcy Will Not Affect Calpine's Commitment

San Jose, CA -- In response to Pacific Gas and Electric Company's (PG&E) April 6th Chapter 11 filing, Calpine Corporation, the San Jose, Calif.-based independent power company, stated it is confident that PG&E, through a successful reorganization, will be able to pay Calpine's Qualifying Facility (QF) subsidiaries for all past due power sales, in addition to electricity deliveries made on a going-forward basis. Calpine's QF subsidiaries sell power to PG&E under the terms of long-term QF contracts at eleven facilities, representing nearly 600 megawatts of electricity for Northern California power customers. As of March 31, 2001, Calpine has recorded approximately $267 million in accounts receivable with PG&E, plus a $68 million note receivable not yet due and payable. The company's remaining California operations, totaling approximately 700 megawatts of capacity, provide electricity to municipalities and other creditworthy third parties. Calpine's QF facilities are part of a 9,000-megawatt QF supply that provide California customers with a long-term source of electricity at prices significantly below current wholesale prices. This critical power supply represents approximately 33 percent of the state's power demand. Without these contracts in place for this summer, California faces the prospect of more blackouts and hundreds of millions of dollars in increased costs. For these QF contracts to continue, PG&E must assume the contracts in the bankruptcy proceedings. In order to assume these contracts, PG&E will be required to cure all outstanding defaults, including paying all past due amounts. If PG&E fails to assume the contracts, Calpine's QF subsidiaries will be able to sell power on the open market and seek damages from PG&E for breach of contract through the bankruptcy claims resolution process. "As the state's leading developer of new electric generating facilities, Calpine remains committed to providing innovative solutions for California's energy crisis," stated Calpine CEO Peter Cartwright. "Calpine's natural gas and geothermal Qualifying Facilities offer a critical, immediate and long-term electricity supply for California power consumers at attractive prices. We will continue to work with PG&E to resolve these issues and will be actively involved in all bankruptcy proceedings to ensure California power consumers can benefit from these vital energy resources."

Related News

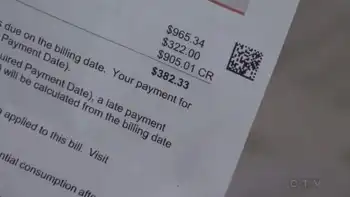

Ontario tables legislation to lower electricity rates

TORONTO - Ontarians will see lowered hydro bills for the next 10 years, but will then pay higher costs for the following 20 years, under new legislation tabled Thursday.

Ten weeks after announcing its plan to lower hydro bills, the Liberal government introduced legislation to lower time-of-use rates, take the cost of low-income and rural support programs off bills, and introduce new social programs.

It will lower time-of-use rates by removing from bills a portion of the global adjustment, a charge consumers pay for above-market rates to power producers. For the next 10 years, a new entity overseen by Ontario Power Generation…