Metro-North stands by century-old system as it replaces its power lines

By Knight Ridder Tribune

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Some of that power is still being drawn from wiring and equipment erected 100 years ago. Metro-North is working to change that.

Since 1993, the railroad and the state Department of Transportation have been incrementally replacing the overhead catenary wires used by New Haven Line trains. These wires were installed as part of its state-of-the-art high-voltage alternating-current power system that went online between Woodlawn, N.Y., and Stamford in the summer and fall of 1907.

The New Haven Line was considered a pioneer for using this kind of electrical power, which promised and delivered higher speeds and more efficiency than its steam-powered predecessors, and the lower-voltage, direct current, third-rail power adopted by New York Central's Hudson and Harlem lines.

But the strain on the New Haven Line's landmark system has never been greater.

Ridership is at its highest point since company mismanagement and the rise of the state's highway system nearly sunk the railroad 50 years ago.

The New Haven Line's wires and tracks are also shared by the regional rail service Amtrak and its high-speed Acela train, which travels as fast as 120 mph on sections between Greenwich and New York City.

"These decisions made over 100 years ago are still with us today," said Kurt Schlichting, a Fairfield University professor and author of "Grand Central Terminal."

Parts of the New Haven Line's electrification system have changed dramatically since 1907.

The coal-powered plant in the Cos Cob section of Greenwich, designated a National Historic Engineering Landmark because of its breakthrough in engineering achievements, closed in 1986 because it could no longer produce enough electricity to power the line.

It was demolished 15 years later.

The overhead wires on the Danbury branch between Danbury and South Norwalk were removed in the 1960s for political and financial reasons, creating an antiquated commuting experience still experienced today for passengers on the vital branch line. As the old overhead wires on New Haven Line's main line start disappearing and new ones appear, Metro-North is still looking for ways to refine and improve the vision of Westinghouse Electric Company's George Westinghouse, who 100 years ago fought vociferously for the current electrical system despite loud objections from rival railroads.

About 20 years ago, Robert Walker, director of operating capital projects and a former power department chief for Metro-North Railroad, was investigating ways to improve the overhead catenary wire on the New Haven Line.

The wires, primarily installed from 1907 to 1914, were prone to snapping in extreme temperatures.

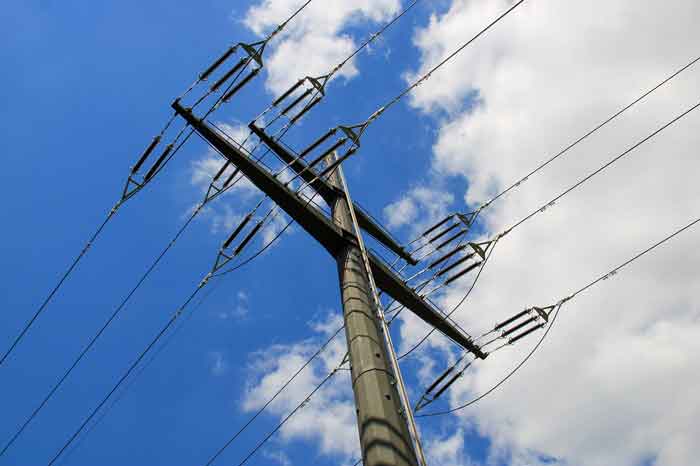

When the weather was too cold, the wires would become rigid. When the weather was hot, they would sag and could get caught on the rail car's pantograph, the arm that draws power from the catenary. The answer was a new kind of catenary called "constant tension" being used on British railroads.

Constant tension used weights and pulleys attached to the wires and poles to help compensate for sagging and restriction.

"It was state-of-the-art," Walker said. "The tension would remain the same despite the weather with weights and pulleys. That way, the system is stable."

In the early 1990s, Metro-North Railroad started removing the triangular catenary - the original 1907 wires that were enjoined by three-eighths of an inch steel gas pipes, forming a triangle.

By December 1993, the new constant tension wiring had been installed between Pelham, N.Y., and the Connecticut state line. By 2002, Connecticut's DOT started removing its own catenary.

The $300 million project started with the removal of triangular catenary between Greenwich and Stamford, which was finished in May 2005. DOT then moved to a section between Stratford and New Haven, which housed catenary from about 1914. That project was completed in February.

The remaining catenary between Stamford and Stratford is under construction and should be completed by 2014. Besides the replacement of the New Haven Line's 30-year-old rail car fleet, the catenary program is considered to be a key project that could lead to improved and more frequent service.

When asked about improving train service during a meeting of the Connecticut Rail Commuter Council, George Walker, Metro-North's vice president of operations, said, "I've got the rail, I just need the catenary."

The results of the catenary replacement project are small but noticeable.

On-time performance on the New Haven Line's inner portion, between Stamford and Grand Central Terminal, has sat at 97.7 percent to 97.9 percent since the new wires went up, compared with 96.9 percent to 97.4 percent in the years preceding the new catenary.

On the line's outer portion, between Stamford and New Haven, where there is less new catenary, the on-time performance has remained at 95 percent to 96 percent the past seven years, according to Metro-North.

The results are not reflected by on-time performance alone, Walker said.

In areas where there is new catenary, the railroad uses a three-year inspection cycle, compared with an annual inspection in areas with the old wires, he said. The new wire also enables the railroad to cut back on its weather-related speed restrictions.

With the old wires, whenever the weather was hotter than 90 degrees or below 25 degrees, the trains would run as much as 30 mph slower.

Catastrophic incidents can still result after wires are torn down.

Earlier this year, about 80 trains and 59,000 commuters were delayed when a pair of rail cars tore down wires outside the Cos Cob station.

The incident took nearly two hours to rectify. Even that is an improvement, Walker said.

"When we do get an incident that tears the new wire down, we can put it back up at least 50 percent quicker because the new system has less components that are easily fixed or replaced in less time by our crews," he said.

As the DOT and Metro-North continue to upgrade areas that have electrical power, they also have to address parts of the railroad that have been de-electrified. During the New Haven Line's electrical age, no rail line has regressed as much as the Danbury branch.

It was first electrified in 1925, but by the 1950s, railroad President Patrick McGinnis decided to sell the wires for revenue.

For service, the railroa used newly purchased FL9 locomotives, which were diesel-powered and equipped to run on the third-rail portion of the railroad between Pelham and Grand Central. The Danbury branch has never been the same.

The diesel engines take longer to accelerate and affect the line's on-time performance. This past year, the 6:52 a.m. train out of Danbury was cited as the most frequently late train on the New Haven Line, arriving on time 88 percent of the time. The line also has suffered because the electric cab cars used on New Haven mainline and the New Canaan branch are not compatible with the unelectrified area.

So if there are equipment problems on the Danbury branch, it can't receive help from the other lines. Rodney Chabot, a New Canaan resident who grew up riding the Danbury branch when it was electrified, is still outraged by the decision to remove the catenary.

"It was working beautiful," said Chabot, a former chairman of the Connecticut Rail Commuter Council. "The diesels have been a failure."

Chabot and other rail historians are convinced that in addition to the funds received for selling the wires, the catenary was removed to justify the purchase of the FL9s. DOT has had plans to improve the Danbury branch for years, but little, outside of studies, has occurred.

The first phase of the most recent study, which was completed last year, determined the line could be improved if it was signalized and electrified gain.

Many of the improvements would cost about $200 million, though ridership would nearly double from its current 1,000 riders a day.

Rail historians and engineers have long praised Westinghouse's vision. But even 100 years later, New Haven Line operators have combated complications because of the decisions of their predecessors.

During the winter of 2004, so many of the New Haven Line's antiquated rail cars were out of commission for repairs that the period was dubbed the "winter of woe."

While Metro-North's other lines, Hudson and Harlem, which are owned by New York, were enjoying new rail cars that were running without as many problems, that equipment could never be transferred to the New Haven Line because it doesn't run on an alternating current system using overhead wires.

Service delays involving the third rail are often less severe, Walker said.

"When we have incidents (with the catenary), it often affects adjacent tracks," shutting down more available tracks for service, he said.

"With third rail, it's usually on track and it's an independent problem, so it doesn't affect service as much."

These issues have resulted in cries to extend the third rail that exists south of Pelham all the way to New Haven.

These requests have generally been rejected because of expense, and because Amtrak, which runs along the entire Northeast corridor, would still need the catenary.

Ordering new rail cars also has been a complicated process because they require compatibility with overhead wires and the third rail into Grand Central.

"The New Haven Lines cars were the first ones to require that (dual power) and have maintained their reputation as being the most complicated commuter cars in the world," Walker said.

But the railroad still stands by Westinghouse's vision.

"The decisions that were made were the right decisions," Walker said.